Today hotel sector in Ukraine shows the impact of investment supply from foreign and domestic investors. Hotel business in Ukraine is at the infant stage, but the analyses show that in recent years this sector develops stable and dynamically and has huge potential and prospects, however it’s still one of the most underdeveloped segments of commercial real estate and takes one of the last places in the list of European countries. Currently there are 1300 hotels, 3200 recreational complexes and more than 4000 hotels are registered on private entrepreneurs.

Investment attractiveness of Ukrainian hotel business is based on the overall business activity, tourist interest, geographical position, improvement of interchanges and investment potential of Ukraine.

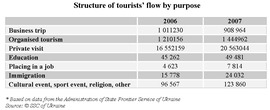

Encouraging factor of hotel business development is stable growth of tourists’ flow. For 2007 23 122157 Mill of foreign citizens visited Ukraine, that is almost 4 Mill more in comparison with the previous year.

At the same time the priority type of tourist activities in Ukraine remains domestic tourism. During the 9-months the growth rate was 74% while for the same period in 2006 – 47% and it continues to grow, only in Kiev the growth of domestic tourism till 2010 is expected to increase in 6 times. Significant influence has the growth of foreign private and business tourism and the growth of business activity inside the country, the increase of business negotiations and its level.

Unique historic monuments and nature, which all regions of Ukraine are rich for, always attract hundreds of thousands of inquisitive travelers from all over the world. The most popular regions for this market development are the capital, the Black and the Azov Sea coasts and the Carpathians. In the second half of the 90th the existing hotels couldn’t suggest their clients the new level of high quality services, though the prices were so high that even wealthy vacationers preferred foreign resorts.

More than two and a half thousand kilometers of the Ukrainian sea cost suggest the investors the most varied possibilities: from the building of luxury expensive hotels and tourists’ complexes with swimming pools, golf courses and other first-class amusements to decent seasonal campings for mass clients. Focusing on wealthy tourists it’s necessary to be ready to compete with the travel industry of other countries of Black Sea and Mediterranean watersheds and to suggest the new qualitative services or considerably low prices. Besides it should be taken into consideration that Ukrainian sea cost is nevertheless the area of seasonal rest and such objective factors as sea pollution and Chernobyl phantom will still be for a long time on the competitors’ side.

In this area the projects oriented for mass client with average incomes and not only from Ukraine might be more profitable for investors. The renaissance and boom of travel business on Ukrainian sea cost can return to Azov and the Black Sea the number of vacationers from the CIS countries and less wealthy tourists from foreign countries by rendering qualitative services at lower prices.

Unlike southern resort area the Carpathians attract tourists almost every year. The most profitable funds placement can be the investment in building of not only large but small centers of winter rest with ski runs on the numerous slopes and hotel- restaurant complexes. Experience shows that when the season is at its height, the most profitably is to depend on hotel services on the basis of property of local people (besides, it’s reasonable for other resort areas and it doesn’t need large investment). In summer time, quite good profits will bring the investment placed in development of the Carpathians’ footpath, cycling, horse routes and also extreme rest and sports such as rock climbing, rafting, etc.

Recently the health-improving tourism became more popular in Ukraine. Inexpensive but qualitative medical services (often unique), mineral water and therapeutic muds, salt caves and herbal- therapeutic treatment attract more and more patients not only from Ukraine and CIS countries but from highly developed countries with expensive medical services. The investment in such kind of medical centres and organization of such travel tours undoubtedly will prove to be quite profitable.

Finally, while investment placing the cultural & historic connections and interests of various countries in Ukraine also shouldn’t be neglected. For example, as expected the tourist Crimea objects will activate investors from Great Britain, Russia and Turkey, Greek businessmen undoubtedly will show great interest in Odessa region, Canada and the USA – in Western Ukraine.

Hospitality industry of Ukraine is one of the most dynamically developing. During January-June 2008 the volume of provided services made up to 1.3 billion UAH that is 432.9 Mill UAH more in comparison with the previous year.

Ukrainian hotel services market just goes on the stage of its development and it’s characterized by low level of market saturation and high demand. For example, the average fulfillment of Kiev hotels is 58% and in the downtown – 75-80%. Low competition allowed hoteliers to overstate prices.

The main factors of hotel demand growth are the closeness to EU and preparations to EURO-2012. The host cities for the UEFA championship Cup – Final in 2012 are Kiev, Donetsk, Dnipropetrovsk, Lviv, Odessa, Kharkiv which are the most dynamically developing in hotel real estate of Ukraine.

According to UEFA demand, Ukraine should provide 5.5 thousand rooms in the 4-5 – star hotels (1.6 thousand rooms are available today) and 5.6 thousand rooms in the 2-3 – star hotels(3. 9 thousand -available). We can clearly observe the deficit for hotels.

According to the Kiev city program of championship Cup – Final in 2012, which was approved on the 31.01.2008 by the Kyivrada, the quantity of rooms will be:

- 4856 rooms – in the 5 star hotels;

- 3608 rooms – in the 4 star hotels;

- 7056 rooms – in the 3-star hotels.

In general, till the end of 2012, 35 hotel objects are planned to put into operation in Kiev.

In Lviv for 7 months of 2008 24 permissions for hotels construction were issued, in comparison currently only 36 hotels are operating in the city.

According to the UEFA requirements, Kharkiv must have 1927 5-star rooms, 1335 – four and 175 – three. Currently, the deficit for luxury rooms is 2800.

UEFA Committee, who checked this year the preparations for the EURO-2012, said that none of the cities of Ukraine is ready to receive the large number of fans. Odessa goes forward by solving this problem through settlement on the comfortable liner the tourists who will arrive in the Odessa sea port. However, from long-term experience, investors examine big projects related to such events very doubtfully. While negotiations of EURO-2012 organizers and Sochi-2014 with major investors, the last announced that the project of hotel building can not be repaid for 2 months of event conducting, as such business plans are calculated on the average for 20 years depending on the star ratings.

The lack of hotels, low competition and supply in the hospitality market are characterized for all the territory of Ukraine.

Free niche of hotel business, due to the lack of rooms, was occupied by apartments, houses for rent, real estate agencies, private brokers and by owners who rent 24-hour apartments. The volume of this real estate market is estimated in more than 30%.

This kind of business is practically shady. The part of apartments, real estate agencies, private brokers specializing on the renting which are working lawfully does not exceed 15%. Flats with good repair, VIP-level apartments attract customers by more flexible pricing policy and level of comfort. The rental rate for single-room is $ 60-145, two- room – up to $ 190. Only Senator Apartments (the fulfillment of which is 85%) is the only apartment complex in Ukraine, which meets all international standards.

The important factor of investment hotel business attractiveness is the investment attractiveness of Ukraine, so every year more and more visitors go to our country and correspondingly the demand for quality hotels increases. From 01.01.2007 to 01.01.2008 foreign investment in Ukraine increased from $16.3 billion to $22.9 billion.

The fact that Ukraine became the member of WTO and the increase of international trade positively influences on the market development.

Ukrainian export merchandise trade volume for January-June year 2008 made $ 32542,2 mln., import volume made $ 42387,4 mln. During 2007 EU countries export came to$ 13916,8 mln. and increased comparing with year 2006 for 15,1%, correspondingly import came to $ 22217,9 mln., 37,2%.

The indicator of investment attractiveness growth is expansion of Ukrainian investors and international hotel companies.

French hotel operator Accor within five years is going to open at least one four-star hotel in Kiev, Dnipropetrovsk, Donetsk, Zaporozhye, Odessa and Kharkiv.

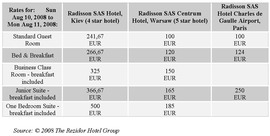

The Rezidor Hotel Group, which opened in Kiev in 2005 the 4 – star Radisson SAS hotel, intends to open in 12 major cities of Ukraine, as well as in 22 smaller, the hotels under its brands.

InterContinental Hotel Group is going to open in Kiev till the 2010-2012 four hotels under InterContinental (five stars), Crowne Plaza (four stars), as well as two Holiday Inn (plus three stars) brands.

Ukrainian Hotels Company, the part of Astron Ukraine corporation, made the agreement with Wyndham Hotel Group to open the Ramada hotel chain in Ukraine. In general, 15 hotel projects under Ramada Encore, Ramada, Ramada Plaza brands are planned to be implemented.

The VS Energy company, the owner of Premier Hotels hotel chain, in 2008 intends to invest in its development $ 200 Mill. The funds will be directed for increasing the number of rooms and hotels’ reconstruction.

The Moscow Government is interested in construction project of five star hotel complexes on the Kerch peninsula in the Crimea, the estimated cost is $ 1 billion.

The Russian company Intourist also intends to enter Ukrainian market. It expects to have 3-5% (about $ 800 million) of the travel market by purchasing one of the local travel company and hotels in Kiev and the Crimea

Kempinski Hotels & Resorts, which left Ukraine some years ago, started to work on the five star hotel project for 500 rooms in Yalta which costs $ 150-170 Mill. The return of Kempinski to the Ukrainian market is a signal that the domestic market becomes more attractive for foreign investors.

The recreational areas of our country also should be noted, primarily – the West and South of Ukraine. In 2005 in Truskavets the first five-star hotel in Western Ukraine for 434 rooms was opened, a member of the Turkish hotel chain Rixos. The main problem in the recreational zone for the major investor can be a deficit of land. During the rapid 90-th, many land plots on the coast were divided between private individuals and today it might be impossible to find suitable land for large investment projects e.g. in Zatoka.

International hotel companies announced their intention to enter Ukrainian market in the early 90 – s, but the reasons of their projects’ failures were the bureaucracy and corruption. Ukraine is characterized by the lack of good projects, top managers and skilled staff. Ukrainian businessmen and officials do not fully understand the significance of international standards, international management companies and brands. Due to the unawareness of Ukrainian market specificity and Ukrainian mentality international companies want to enlist officials support or to find local business partners, who later on tried only to earn from them. Such business has specificity which distinguishes it from other projects supposing the use of property as the basis of future business activity. These differences appear at the construction stage (siting, projecting) and at the stage of operation (management services, sales strategy, etc.). In this context, the development of investment project and its success supposes professionals involvement

The approvement by Verkhovna Rada the bill aimed for support of investment development in hotel business will increase the investment attractiveness of the market. The bill is suggested to reduce the VAT from existing 20% to 10%, the delay in payment for profits, reducing the tax for land for the period of hotels construction.

It can’t be missed that on December 26, 2007 the Law of Ukraine № 877-V “On the main regulations of state control in the sphere of economic activity” joined into force which aimed to introduce proper order in the implementation of state control.

The great advantage while investing in hotels construction is its independence from political and economic crises. The owners of hotels by no means can feel the consequences of index decline and the currency movement. Some real estate European companies announced that they invest 15-25% of the funds in hotel business, for portfolio diversity, as insurance against economic looses.

According to the market economy rules, unsatisfied demand can’t exist for a long time. Therefore, in future the supply of domestic and foreign investment in hotel business is surely expected. Even despite such problems as corruption of our officials and relatively long payback period, investors will increasingly occupy this market segment

Good potential areas for investment are Kiev as the capital, the Crimea, Lviv and Odessa as resort centers, and Kharkiv, Donetsk, Dnepropetrovsk, as large industrial centres, all the more almost all mentioned regions are included in the application as the hosts of the future EURO-2012.

Hotel Business is the excellent way for investment which without extreme risk will make money during the years. Considering economic potential, geographical location and climatic conditions, Ukraine has great advantages to become the major tourist centre of Europe.