The tourism industry in Ukraine demonstrates the fast rates of growth for an extended period of time. For the last 5 years industry growth has come to 12-15 %; growth of internal tourism has made 5 %, the number of foreign tourists has increased by 19% in 2003 and by 10 % in 2004. The profits that travel companies generate increase (due to increase of purchasing power of domestic population and increased number of foreign tourists), as well as the number of services those travel companies are ready to provide.

Such a positive tendency certainly leads to an increase in demand for the hotel services. However, the analysis shows that the Ukrainian hotel industry reacts to the changes of market conditions too slowly. A growing demand is satisfied basically with so-called “private sector” (renting of apartments and houses) especially during the peak periods, whereas the hotels services remains poorly demanded. It is possible to single out two main reasons for this low demand:

- Actual level of service is below declared. The majority of 3 and 4 star hotels have not been renovated for more than 10 years and is below the standards requirements.

- The lack of hotels in the most mass average price segment (in a number of cities, such as Kiev and Odessa, municipal programs are accepted on development of chains of 3 star qualitative hotels, however these programs remain on a paper because of absence of investors till now).

Why has such paradoxical situation developed where demand for hotel services on all parameters and forecasts exceeds existing supply?

Majority of experts agree that the main causes could be explained by uncertainty about future demand for services. Nowadays, it is challenging to determine the future trends of the tourism industry, hence, the return on investments. The second reason is believed to be a financial sector:

- Investments into hotel industry are perceived as unattractive by domestic investors since those usually require large funds and considered to be long-term. At the same time, there are more attractive industries for the investments, allowing returning of funds in 1-2 years, instead of 4-7 years, as in hotel business in Ukraine).

- Absence of the long-term and affordable financial sources, accessible to the domestic companies, which makes impossible the application of financing mechanisms (so common for “western business”) for building and development of hotels,

- Absence of the strategic investors on the Ukrainian market that would be able to attract investments in demanded volumes.

The other reasons include:

- Still relatively low purchasing power of local population (though improvement of parameters has been observed in 2004 and 2005).

- Low demand for hotel services from B2B (business travelers etc.).

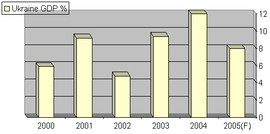

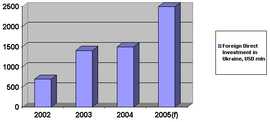

Nevertheless, the expected future trends in economy (growth of GNP was about 12 % in 2004 and by some estimations it will be kept in 2005) and in tourism (the share of tourist industry has increased from 1,26 % of GNP in 2000 up to 1,56 % in 2003) make the hotel business attractive for the potential investors for at least the next 3-4 years. Some experts expect boom in the real estate business due to a rapprochement between Ukraine and EU. Taking into account that in the countries of the Europe and the USA hotels basically enter into franchise chains, it is possible to predict arrival on the market leading hotel’s operators, and along with them – investors (traditionally the majority of funds is invested into well-known hotels that are the part of famous international hotel chains, well proved on the international market).

Even prior to well-known “orange revolution” that took place in Ukraine at the end of 2004, leading hotel business players studied the Ukrainian market and planned entering into it. However, the majority of the companies were disturbed with existed by that time political instability which questioned the reliability of the government guarantees.

At the present time such giants as Radisson, Hyatt (ISD in 2005y. has involved the credit of the IFC for hotel construction of this brand in Kiev, Ukraine) already work on the Ukrainian market along with some other operators. In addition, Ukrainian market is in the sphere of close interest of Hilton, InterContinental, Marriot and Kempinski (the last one had a bad experience of creation of hotel in Odessa which after commissioning has not entered into the chain). Such known operator as Accor did not plan the presence in Ukraine until recently at all, however, it seems reasonable to expect changes of intentions of this operator. There are brands of 3 star hotels in its management which can be demanded and their parameters of ROI can interest even the Ukrainian investors.

Foreign countries’ Regional hotel chains demonstrate the interest in Ukrainian market (the number of tourists coming from those countries to Ukraine has increased in 2003: from Slovakia – in 2,5 times, Poland – in 2,2 times, the USA – in 1,7 times, Italy – in 1,6 times, France – in 1,5 times, Turkey – by 43,0 %, Germany – by 24,8 %.) It makes their national hotel brands attractive as loyalty of tourists to “their” brands in another country is usually high enough and due to it hotels of the given chains can receive a target audience at once.

As a whole, it is possible to predict formation of national chains in the near future due to consolidation in the market (for example: Premier Hotels) and rather active entering into the Ukrainian market of the foreign hotel chains (at present there are 2 hotel rooms per 1,000 Ukrainians; this demonstrates the presence of attractive and yet not occupied niches) which can invest significantly in construction of the new hotels as well as renovation of the old hotel facilities. All that would allow to improve the quality of service and to reduce the price of services to the Central European level.