Ukrainian hotel business remains one of the most underdeveloped segments of the real estate market. Hotel infrastructure does not satisfy the demand for hotel services neither in quantity nor in quality. Most hotels were built 30-40 years ago and since then have not been renovated and is below international standards.

In spite of this fact, hotels’ profitability improves. According to the data of Statistic State Committee, from January to December 2007, the volume of realized services have increased significantly by 24% and has come to 2016, 4 million UAH. (For 2006, the volume of services was 1521.1 mln. UAH). The market of qualitative commercial real estate projects has been taking shape since early 2000s.

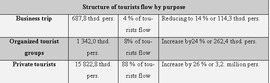

Annual growth of inbound tourism is one of the factors of hospitality development. Only for 9 months of 2007, the amount of foreign tourists who visited Ukraine reached 17.9 million that is 24% (or 3.4 million people) more than in the same period of 2006. According to forecasts only in Kiev domestic tourism will increase in 6 times by 2010.

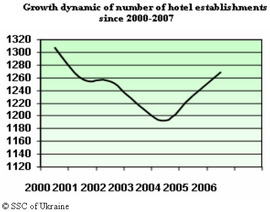

There are 1269 hotel establishments in Ukraine (1308 hotel establishments to compare with the same period of 2000) and 1244 corporate apartments. The number of sanatoriums, rest homes, vacation houses, etc. exceeds 3,200. The growth of hotel occupancy occurs as a result of the fluctuating relationship of supply and demand. (Разные данные)Today accommodation services are provided by 7 five-star, 39 four-star hotels.

The positive tendency can be observed since 2004, when Ukrainian economy had shown fast rates of growth. The well-known «Orange Revolution” as a result the change of state government and radical reorientation of Ukrainian domestic and foreign policy catalyzed the interest of investors. Another reason was the 50th anniversary Eurovision show.

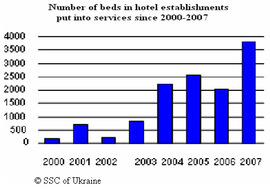

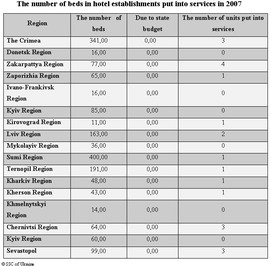

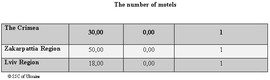

According to the data of Statistic State Committee, 3797 beds were put into services in 2007 (which is 1752 beds higher than the same period in 2006).

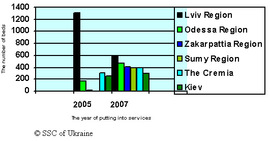

Lviv, Odessa, Zakarpattia, Sumy and the Crimea are leading regions according to the number of beds that were put into services.

Dominant players in hotel investment market and major Ukrainian financial groups are attracted by the increase of demand and low competition of hotel services.

Currently Ukrainian hotel operating businesses offers reasonable balance between the level of risks connected with investment and the level of expected profitability or capitalization rate.

Ukrainian retail market is the fourth in the world by investment attraction (the data study of international consulting company “A.T. Kearney”).Ukrainian commercial real estate investment is at the record-high level (95% of foreign investment).Hotel real estate market of Ukraine is the second according to investment attraction after commercial and office.

Ukrainian hotel real estate supply is less than 5% a year, demand is up to 20% a year. Profitability of 4 and 5 – star hotels exceeds 40%. The average level of fillability of functioning hotels comes in Kiev to 60-70 %. The prices for accommodation services in the hotels of Ukraine evidently are slightly exaggerated.

Hoteliers overestimate prices up to 30-50% (as compared with Western European capitals) due to the low rates of new hotels construction. At the beginning of 2007 the average price per room for 24 hours : in five-star hotel was $300-800, in four-star – $120-40060, in three-star –$50-220, two-star – $ 40-100, one-star – $25-100 with a stable tendency to rise. The price for hotel services exceeds the average cost of hotel accommodation in Prague, Budapest, Warsaw and even in Munich.

Hotel business in Kiev can be one of the most promising and successful in Ukraine. Today there are177 hotels in the capital but only 50 of them has been certified (however, not all of them provide high-quality services that meet the requirements of the national classification). For comparison, there are 1,5 thsd. hotels in Paris and 1,7 thsd. – in London. There are 6 hotel beds per 1,000 inhabitants in Kiev, while in Moscow – 9, in Paris – 38 and the average index for Europe is 14-18. There are 35 hotel projects at the different stages of development that will put into services by the 2008-2011. Among them: 6 – five-star hotels, 10 – four-star hotels, 17 – two and three star hotels. However, other big cities and recreational Ukrainian territories (Crimea and the Carpathians) are no less investment attractive.

Currently the Ukrainian hotel market is dynamically developing. But it wasn’t always so. Darren Blanchard (consultant in Ukrainian hospitality) recorded the failures of more than 20 hotel projects over 15 years, mostly – international brands (Hilton, Sheraton, InterContinental, Kempinski). The main reasons for such failures are misunderstanding rules of organizing business in Ukraine, lack of reliable Ukrainian partner or dealing with companies that do not realize how business in Ukraine should be organized and developed.

Over the past years international public hotel operating companies actively show interest and make negotiations about possible projects. Currently three public hotel operating companies Global Hyatt Corporation (in July 2007, 5-stars hotel Hayatt Regency “ Saint Sofia Kiev” started operating under Hyatt brand), Rezidor Hotel Group (2005 – four-star Radisson SAS Hotel Kyiv), Rixos Hotel (2005 – five-star Rixos Hotel Prikarpatye) are doing business in Ukraine now.

At the present moment there is one national hotel network “Premier Hotels” that consists of seven 4 and 5- stars hotels in different cities of Ukraine ( there were only two hotels to compare with 2003). And there is one managing company “Premier International” which represents “Premier Hotels”.

Public hotel operating companies are primarily driven by their strong motivation to widen brand representation in Ukraine. In 2005, Hilton Hotels Corporation, InterContinental Hotels & Resorts, Marriott International, Kempinski Hotels&Resorts and Accor Group wanted to enter Ukrainian hotel market. In 2007 , InterContinental Hotels & Resorts, Hilton Hotels Corporation, Starwood Hotels & Resorts , Marriott International, Accor Group, InterContinental Hotels & Resorts, Magic Life, Kempinski Hotels&Resorts, Continent Hotels & Resort, Choice Hotel International, Wyndham Worldwide have announced their close interest in Ukraine.

Rezidor Hotel Group, Global Hyatt Corporation, Rixos Hotels are going to improve their positions in the Ukrainian market.

$ 1.8 million are planned to allocate in rise of tourism attractiveness of Ukraine over the world. The money will be directed for advertising film ” Ukraine invites” and participation in 12 international tourism exhibitions in Chicago, Tokyo, Moscow, Tel Aviv, Milan, Madrid, Vienna and other cities.

A number of reasons contribute to positive changes and the following of them are believed to be the most important:

- Ukrainian economy is relatively stable (for 11 months 2007, the GNP increased to 7,3%)

- foreign policy of the country has changed;

- the investment climate inside Ukraine has improved;

- the tourist attractiveness of Ukraine has increased;

- the EU borders are coming closer and Ukraine is being gradually integrated into the European and world community;

- business is getting more active inside the country;

- the existing hotels are not able to meet the current demand;

- the demand for world level departments is permanently growing;

- the capital of investment companies has increased.

There are no doubts that hotel business is one of the most promising. Hospitality can be one of the most profitable and successful business areas in Ukraine. Due to its geographical location and climate Ukraine enjoys good chances to turn into one of the largest tourist centers of Europe.